Don’t be surprised by additional fees when you buy cosplay accessories from foreign countries. Our guide offers advice for cosplayers in the UK, EU and the USA

Picture the scene: you’ve bought that perfect anime wig/lightsaber/C.o.D armour (delete as appropriate) online, from a company based abroad. Your new item will be with you in days. Brilliant! That was easy.

The excitement builds, but, on the day it should arrive, instead of said item, a ‘fee-to-pay’ card drops on your doormat. Your item won’t be delivered until you pay the excess charges, which may include:

• VAT

• Import duties

• Courier admin/handling fees

These fees can strike unawares if you shop online and buy cosplay costumes and accessories (or any products) from abroad – including places like China, Hong Kong, the US or the EU.

Importing a product into the UK

This guide is based on bringing goods into the UK, but similar principles exist in most countries, though the rates may vary.

If you are looking for imformation on importing into the USA or the EU, you’ll find details included further into the guide.

Keep it to £135 or less!

You shouldn’t face any extra duty charges if your order costs £135 or less. Following Brexit, EU sellers must register with HMRC (the tax office), in order to sell to the UK. This may explain why some small online retailers have stopped selling to UK customers, as they would incur extra costs and hassle.

How it works

Your courier company will let you know if you need to pay any VAT, customs duty or delivery/handling fees to receive your goods, usually by delivering a bill stating precisely what charges you have incurred.

Typically, it’ll hold your parcel for two to three weeks, but, if you haven’t paid the bill by then, your parcel may be returned to the sender or even auctioned off to recoup the courier’s costs.

What do the extra fees consist of?

Customs/Import Duty

These fees are charged on purchases of goods sent from outside the EU, which cost over £135.

Typically, the courier will pay this fee to HMRC on your behalf, but you will have to pay it back, before receiving your goods.

Depending on the items you’ve purchased, these fees range from 0% to 25%. Leather belts and bandoliers, for example, come in at 4%, while trainers are 16%.

You can try to find out what the import fees are for your item, on the government’s gov.uk website by searching ‘Trade Tariffs’. However, it is not a simple process, especially for some bizarre cosplay products!

Customs fees should not be applied to products that originate/are made in the EU region, thanks to a ‘rules of origin’ agreement between the UK and the EU,. This excludes products that have been largely created in the EU from incurring extra taxes.

If in doubt, ask the retailer if customs duties are likely to apply.

Import VAT

Import VAT is the charge that you pay on items brought into the UK from abroad. Within the UK, normal VAT is charged on applicable items and services when you pay for them. However, when you import a product, you may be charged ‘import VAT’ on the total cost of the item. The standard UK import VAT rate is 20%.

Courier admin and handling fees

In some cases, as the courier has paid import tariffs, it may demand extra admin fees before delivering your item. If you don’t pay these, you will not receive your order.

Examples of the fees charged to administer the customs process, include the Royal Mail £8, UPS £11.50 and DHL 2.5% of the package value (with a minimum charge of £11).

What if I’m overcharged, or return my goods?

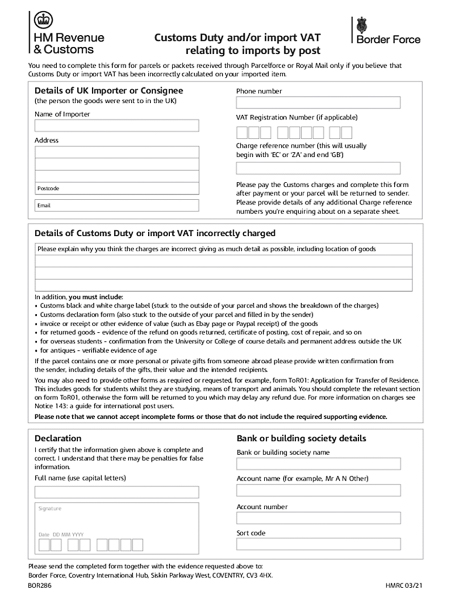

You can request a refund of VAT and/or Customs Duty by downloading and filling in a refund form…

• form BOR 286 if Royal Mail/Parcelforce delivered the goods.

• form C285 if a courier or freight company delivered the goods.

Tips & info

• Anything couriered or posted to you from abroad will go through customs checks. They will assess how much, if any, duty you need to pay. This includes anything new or used that you buy online, buy while abroad and send back home or receive as a gift.

• Ask the vendor if the goods you’re buying are likely to attract import duties.

• Consider splitting purchases up so that individual packages are below £135 in value. Of course, this may cost extra in postage… but may still be considerably cheaper.

• If you do receive a customs duty demand on EU goods that you think shouldn’t apply, ask the retailer to send you an ‘origin declaration’, to prove that the goods were made in the EU.

• Remember that VAT is calculated on the cost of the imported goods, shipping, insurance and duties… not just the value of the product.

• Gifts between £135 and £630 in value may attract a lesser customs’ duty (2.5% or lower) than normal goods, so if a friend in that country were to send you a gift…

• While an item sourced abroad may initially seem cheaper than its locally-bought equivalent, you should factor in the potential extra import fees.

• Remember, when buying expensive products, the exchange rate can make a big difference to what you pay, and your method of payment can incur significant costs too, potentially £25 for a bank transfer.

• Be aware of buying fake or pirated items if you are purchasing branded goods.

• Some websites may offer to put a value on the declaration form that is much lower than the price paid, so that you don’t have to pay duty or VAT. This is illegal and may result in seizure of the goods and prosecution.

Importing a product into the USA

US Customs and Border Protection (CBP) monitors and controls goods being brought into the country. It uses specific regulations to control imports, and these rules can be complex, confusing and costly, so ‘buyer beware’.

When buying items from foreign sources, you are the importer. As it’s the importer who takes responsibility for ensuring that the goods comply with state and federal import regulations, you could face financial penalties if you get it wrong. For example, a cosplay weapon, while not real, could be seized by CBP, and admin and storage fees applied before delivery.

These rules apply whether you buy from a manufacturer, retailer or an individual on eBay. If the merchandise that’s imported into the United States is new or used, it must cleared by CBP and may be subject to customs’ tariffs and regulations.

All merchandise sent to the US from abroad must have a US CBP declaration form and an invoice attached, or it may be subject to seizure or forfeiture, or be returned to the sender.

Paying import tariffs

Calculating the import duty on merchandise can be complicated. Shipping services can often estimate what the duty rate on a product might be, but only CBP can make a final calculation.

Usually, a checkout purchase price that includes shipping and handling will not include customs’ duties.

How you pay the customs’ charges depends on how your goods were shipped.

International Postal Service

You’ll have to pay the mail carrier or go to your local post office to pay any outstanding duty and processing fees.

Courier service

The courier service will either bill you for the duty they paid on your behalf beforehand, or they’ll request payment on delivery.

Freight

If the freight company has been paid to deliver your goods to your door, you will be pre-billed for any duty owed to the broker that cleared them through CBP.

If the goods are only being brought into the country, you’ll have to pay the duty directly to CBP yourself, at the port where your goods arrived; or you’ll need to organise for a broker to clear your goods. The broker will then bill you for their services and any tariffs they paid on your behalf.

Remember: US CBP holds you, the importer, liable for customs’ duty payments, not the seller, and only CBP can determine the amount of duty owed.

Informal Entry

An informal entry is the import of goods with a value below US$2,500. It does not need to be cleared by a customs bond, as it is mainly designated for personal importations.

Formal Entry

A formal entry covers goods exceeding US$2,500 in value, and must be cleared by a customs bond. This type of entry is used for commercial importations only, eg: something you’re going to sell on.

US customs tariffs can be calculated using the database at https://dataweb.usitc.gov/tariff/database

Goods imported for personal use, tend not be treated as strictly as those brought in for commercial purposes.

Importing a product into the EU

If you buy a product from a non-EU country, you are effectively an importer and are liable to pay customs tariffs and VAT.

Customs duty is not charged on goods when their value does not exceed €150 (excluding perfume, tobacco and alcohol).

Above this value, the goods will normally be held by customs at the point of entry, awaiting payment of duty and tax.

Import duty is calculated as a percentage of the customs value of the goods (price paid plus insurance and shipping).

The rate depends on the type of goods, and this is where it gets complicated, as there are 5000+ categories of goods, each with a code number that you put into the TARIC database, to find out the customs tariff.

VAT is then charged on the customs value plus the duty paid and the transportation and insurance costs.

VAT is not charged when the total value of the goods (not including customs duties or shipping) is less than your country’s threshold. This threshold varies from €10 to €22, depending on the EU country. Certain countries however, exclude mail orders from the exemption.

This document explains how the customs value is calculated in the EU Member States.

Daniel’s experience

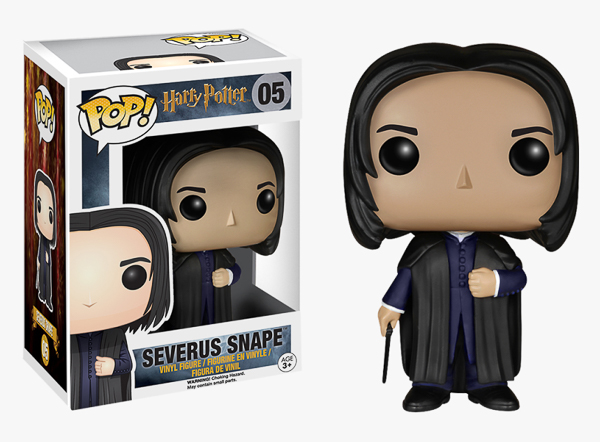

World of Cosplay’s Daniel regularly buys pops in the UK and from overseas so offers this handy tip if you’re ordering from abroad. “If you’re buying several items, it’s sometimes worth considering splitting them into two orders to avoid having to pay any VAT or customs duty. Splitting your purchases into two orders is only worth it if there’s a big difference in what you’d pay in duty compared to the cost of paying postage twice.

“An example is an order I made for some exclusive Pop Funkos from Australian retailer Popcultcha. The total cost of the order was around £250 and so would result in VAT, duty and handling fees having to be paid in the UK. Splitting the order so each totalled under £135 avoided paying duty of around £65 but resulted in having to pay postage on each order of £25 per order. You just need to decide if the saving is worth the extra hassle or not.

All prices and amounts are correct at time of writing (1 Aug 2021).

Author:

John Sootheran

John’s a cosplay photographer and videographer who visited his first con in 2017, and has been to numerous London, Birmingham and Manchester events since.

He finds the cosplay vibe addictive and is one of the team to launch worldofcosplay.com

Leave a Reply